Your e-commerce platform deserves the best payment gateways services in UAE available list and details and understand about the payment gateway and its benefits are mention.

What does the term “payment gateway” mean?

E-commerce platforms can collect payments through payment gateways, essentially online payment services incorporated into the platforms. It functions as a passageway through the internet, leading from the bank account you want to utilize to the platform.

Banks and other specialized financial institutions can both serve as payment gateway providers. Users can now pay with various payment methods, including credit cards, debit cards, UPIs, online wallets, and net banking for UAE finance sector Online Payment gateway services in UAE.

The Payment Gateway Application: What Is It and How Does It Work?

These are the processes you should anticipate seeing throughout an online payment, even if each payment gateway is unique.

- When the user presses the button that takes them to the checkout page, the system redirects them to a payment gateway services in uae where they must submit the necessary information.

- To authorize the transaction, the system will take the user to a secure banking website (most of the time, one that requires an OTP).

- The system completes the transaction successfully if the user’s account has sufficient funds available.

- The system alerts the user by sending a notification, informing them that their order has been successfully placed and the transaction has been finalized.

Using a payment gateway not only streamlines the purchasing process but also lends an air of reliability to the transaction. Because there are so many payment gateways, deciding which is best for your business can take time.

We have provided you with a list that details the benefits and drawbacks of the most popular payment gateways available in the UAE and any additional information you might require.

1. Telr

Telr is currently the most widely used payment gateway in the UAE. Innovative Payments was formerly the name of this business. Customers frequently go with Telr, a payment gateway with operations in Dubai and Singapore that provides services to nations still economically growing. Over one hundred and twenty nations are currently supported by the platform. On the Telr website, you will see the option to create an account. There is no charge for creating an account.

The payment gateway is compatible with the woocommerce platform. In addition to Magento and PrestaShop, Shopify is also supported. In addition to SADAD, Telr acknowledges payments made with Visa, MasterCard, American Express, and Internet Banking provided by Indian financial institutions.

2. CashU

CashU was the first service for making online payments available in the Middle East. was initially designed to service the market in the UAE, but it has now expanded to become a popular option across Europe. The system is well-known for its cutting-edge AML fraud protection features and safety measures. CashU additionally ensures that there is no possibility of a chargeback for any transaction.

CashU charges an initial fee as well as a refundable security deposit. The total amount of your sales determines the annual charge.

3. Checkout

Checkout is a well-known and widely used worldwide payment gateway facilitating straightforward business deals. It provides various individualized solutions, each delivering helpful insights and may be tailored to various markets.

Currently, businesses in the UAE utilize Checkout as one of the most frequently used payment gateways. In the UK, the solution is well-known for offering an outstanding user experience, verified payment integration options, and ease of setup. The transaction charge might range from 0.75 per cent of the total volume to 2.75 per cent.

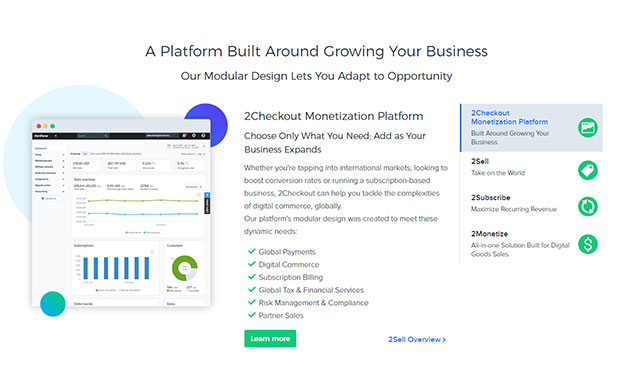

4. 2Checkout

2Checkout is a payment gateway that is universally accepted all over the world. In recent years, it has earned a reputation for being an excellent solution for accepting payment transactions. The system is compatible with transactions from 196 countries, offering support for eight distinct payment channels, 15 different languages, and 87 different currencies.

The well-known accounting software FreshBooks has partnered with the platform to provide additional choices for small businesses seeking to make payments online. Setting up the account or paying a monthly subscription is also free.

5. CCAvenue

CCAvenue is an online payment system that operates as a payment gateway and has its headquarters in India. It is one of the most popular platforms in the United Arab Emirates. The organization is well-known for offering variable pricing plans ideal for all sizes and types of enterprises, including small, medium, and large ones.

The platform is free but with a monthly maintenance fee of approximately AED 200. The primary reason why businesses go with CCAvenue is because of its free services, which include support available 24 hours a day and protection against fraud. There is a fee of 3% attached to each transaction.

6. Source Cyber

Visa is a well-known international firm, and Cybersource is one of its wholly-owned subsidiaries. The platform, which is accessible in more than 190 countries around the world, provides users with a vast range of potential solutions. The primary reason for selecting this platform was to facilitate the use of digital wallets like Apple Pay, Android Pay, and other regional wallets like Alipay.

In 1994, Cybersource established itself and has since earned a worldwide reputation for its forward-thinking e-commerce services and cutting-edge capabilities.. Because it is a component of Visa, you do not need to worry about the safety of your financial transactions.

7. Payment Services Provided by Amazon

Amazon Payment Services, originally known as Payfort, serves as one of the UAE’s most widely used payment gateways. Amazon acquired Payfort in the fourth quarter of 2020. Users highly trust Amazon Payment Services and affirm that it eliminates any potential dangers associated with transactions.

Because it caters to Arab buying patterns and habits, it has become very popular among newly established businesses in the UAE.

8. PayTabs

PayTabs established itself in 2014 and gained a well-known reputation for its forward-thinking features and cutting-edge technology for preventing fraud. Users widely regard it as one of the most trustworthy payment gateways in the UAE, and you can easily integrate it into your existing e-commerce platform.

You can complete the installation and setup of PayTabs in less than twenty-four hours. A useful characteristic of the solution is that it can generate and send invoices using the most recent technological advancements.

9. Pay ceilings

The payment gateway is in Dubai, Abu Dhabi, Sharjah and other major regions of the United Arab Emirates. Paycaps has been a significant provider of payment gateway solutions for websites and apps. Platforms that offer automation driven by an API are becoming increasingly popular among new businesses.

Paycaps can tailor this design to satisfy your needs and feature a streamlined, intuitive user interface. Paycaps offers white-label solutions that companies can customize to a great degree and are extremely adaptable. Each company can customize the layout, types of payments accepted, and themes available to customers according to their preferences.

10. Hyperpay

Hyperpay is one of the payment solutions with the most rapid expansion in the MENA region. The organization has over one hundred banking partners and is affiliated with several of the United Arab Emirates’ most recognized credit card businesses. Its headquarters are located in Saudi Arabia. Integrating the platform with other major e-commerce systems, such as WordPress and Magento, is simple with this one.

Hyperpay offers an extremely secure fraud management system and a checkout process that businesses can modify to suit their individual preferences. The organization handles transactions totaling millions of dollars each year for clients in a diverse set of markets.

11. Stripe

Stripe is a well-known payment gateway in the UAE that allows businesses to take payments from customers and make payouts anywhere in the world. Both offline and online retailers, as well as marketplaces, software platforms, and businesses that rely on subscription models of revenue generation, use this solution.

Additionally, it provides several cutting-edge functions, such as combatting fraud, generating real or virtual cards, sharing invoices with others, and handling financial matters.

If you are looking for an E-COMMERCE WEBSITE SOLUTION and Payment gateway services in UAE